September 17, 2023

8 mins

Much of our day-to-day trading effort is spent on finding good setups and entering them.

However, the most significant factor and differentiator in trading performance is the position size you enter and trail with in a trade.

Size Matters :

Position size for most traders is not a static percentage of the portfolio (e.g. 10% size in every trade). Rather, it is a derivative of the % risk taken on the trade and stop loss.

The placement of the stop loss in-turn depends on the following -

Setup type:Certain setups, such as EPs or IPO bases, are inherently more volatile and may require a wider stop loss, compared to range contraction setups.

Trade Objective:Trades that have a strong reason (WHY) to break out and are held for longer positional plays can afford a wider stop loss. In my opinion, setting an initial stop loss above 4% can reduce the trade's expectancy. Instead, I prefer to wait for a better pivot and use a tighter stop loss.

Entry: Identifying and entering a breakout early provides a significant edge with a tight stop loss and a more favourable risk-reward ratio.

Let's take some examples with basic math:

Setup: The stock is breaking out of a well-constructed, year-long base and forming a Volatility Contraction Pattern (VCP) on the right side of the base. On February 16th, the stock formed a very tight day on low volumes.

Trade Objective: Will look to buy and hold the stock for a longer positional play due to (a) Breaking out of a year-long constructive base after a strong stage 2 up move in 2021. (b) Strong relative strength (c) Strong sector news (d) Multiple pocket pivots - signs of big accumulation.

Risk on Trade: 0.5% of portfolio

Selling Rule: Sell 30% of the position in strength at 4R getting stoploss to cost (the markets were bearish and portfolio was flat in Q1 CY2023), and trail the balance position with 21ema. If there is a parabolic move, sell the entire position if the low of the previous day within the parabolic move is broken.

Entry - 17th February 2023

Tight (Green) - Entry 532, Stop Loss 2% - 521.35 (~Day low), Size - 25%

Moderate (Orange) - Entry - 550, Stop loss 5% - 522.5, Size - 10%

Wide (Red) - Entry 568, Stop Loss 8%, - 522.5, Size - 6.25% (triggered on 20th February)

Tight (Green) - 30% Sell at 574.6 (4R) + 70% Sell at 1440 - (85R) =60.7R

Impact on Portfolio - ~30.4%

Moderate (Orange) - 30% Sell at 660 (4R) + 70% Sell at 1440 - (32R) =23.6R

Impact on Portfolio - 11.8%

Wide (Red) - 30% Sell at 750 (4R) + 70% Sell at 1440 - (19R) =14.5R

Impact on Portfolio - ~7.25%

Comments:

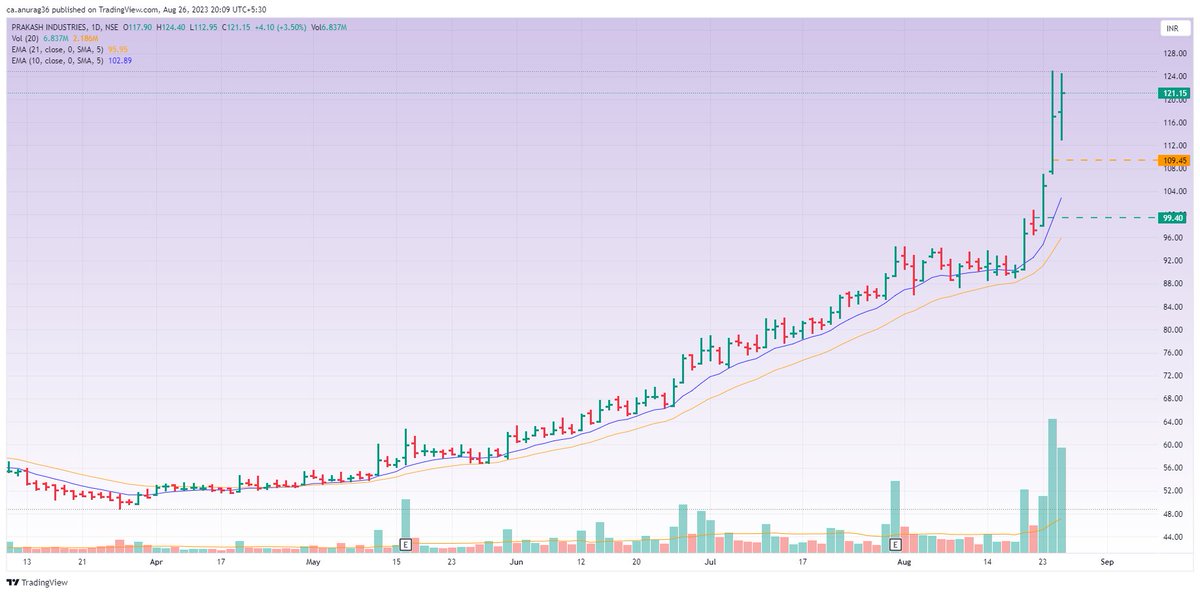

Setup - This strong trending stock is currently moving alongside the 10ema and is now basing after decent results. Momentum Burst, Velocity trade, Flag, VCP - call it whatever you want.

Trade Objective - This is a short-term or swing trade, as the stock's uptrend is not new.

Risk on Trade - 0.5% of portfolio

Selling Rule - Sell 50% of the position when the stock is strong at 4R, and trail the remaining position using either the 10EMA or 21EMA, depending on the stock's behaviour.

Entry - 21st August 2023

Tight (Green) - Entry 92, Stop Loss 2% - 90.2 (~Day low), Size - 25%

Moderate (Orange) - Entry - 94.4, Stop loss 4% - 90.6, Size - 12.5%

(Trailing position taken at unrealised profit as on Friday Close)

Tight (Green) - 50% Sell at 99.4 (4R) + 50% Open at 121.15 - (16R) = 10R

Impact on Portfolio - ~5%

Moderate (Orange) - 50% Sell at 109.5 (4R) + 50% Open at 121.15 - (7R) = 5.5R

Impact on Portfolio - 2.75%

Comments:

Not every good setup or technical pattern is a trade, and not every trade is a technical pattern or a setup. As a trader, your task is to understand the language of charts and then refine the details of your executions to maximize the risk-to-reward ratio. Many of these refinements cannot be found in rule-bound technical books, but rather through first-principle observations and creativity.

Don't replicate the rules of US traders, who have a 4x larger liquid stock universe than we have in India, with much lower margin restrictions. If you observe some of @Qullamaggie streams in bull markets, you will see him holding more than 15 positions often.

There are primarily two ways to achieve super performance in the Indian markets: either size big and hold for a big move, or size big and make many small moves. Taking many small trades and churning for profits is not a great option.

When it comes to trading, everyone has their own preferences and risk appetite. However, there are some ground rules that you need to follow if you want to achieve super performance. Don't make your approach so "comfortable" that it removes the possibility of achieving super performance.

Copyright © 2024 Trade TM | All Rights Reserved | Terms and Conditions | Privacy Policy